Despite this, few studies have evaluated the financial literacy of medical trainees, or evaluated the efficacy of interventions to improve financial literacy and changes in behavior. Yet, even in countries with different physician reimbursement systems, educating medical trainees regarding budgeting, savings, and financial planning could provide significant long-term benefits for individuals and their medical practice. 6 In most other countries, physicians are among the most well-educated and well-compensated professionals, even though their future incomes and levels of commensurate debt may be lower compared to physicians in the US. Financial literacy is not a requirement to be a competent physician, but can significantly impact job satisfaction and productivity. 4 Fewer physicians in the US are choosing self-employment after training, 5 and these physicians may not perceive a need for learning basic finance or business principles, jeopardizing their future financial health. 2, 3 Trainees who choose fellowship training after residency extend their time working at lower income levels while increasing their debt burden. The median debt of US medical school graduates is higher than any other post-graduate training population, 1 with 82% of recent graduates carrying over $100,000 in medical student loans.

#Personal financial statement 2017 professional#

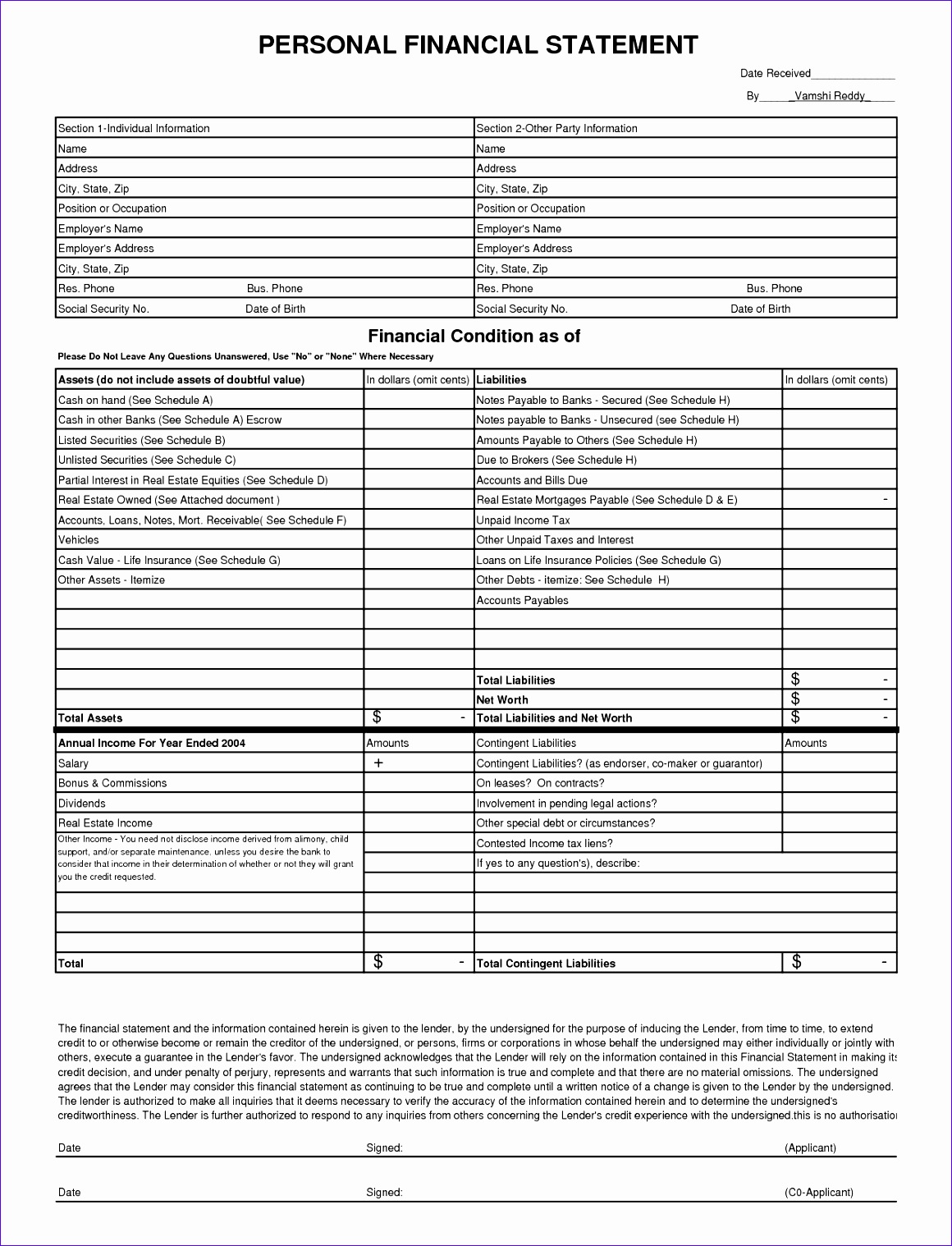

Physicians in the United States earn high salaries after training however they enter the workforce several years after and with greater debt than peers with other professional graduate degrees. Providing education in areas such as budgeting, estate planning, investment strategies, and retirement planning early in training can offer significant long-term benefits. Adding personal financial education to the medical education curriculum would benefit trainees. 001).Ĭonclusions: Residents and fellows had low financial literacy and investment-risk tolerance, high debt, and deficits in their financial preparedness. 001), and weakly correlated with satisfaction with financial status (r=0.23, p <. Knowledge was moderately correlated with investment-risk tolerance (r=0.41, p <. Indebted trainees reported lower satisfaction than trainees without debt (4.4 vs. Respondents’ mean satisfaction with their current personal financial condition was 4.8 (SD = 2.5) and investment-risk tolerance was 5.3 (SD = 2.3). Of 262 respondents with retirement savings, 142 (52%) had saved less than $25,000. Many respondents had other debt, including 86 (21%) with credit card debt. Results: The mean quiz score was 52.0% (SD = 19.1). Of 2,010 trainees, 422 (21%) responded (median age 30 years interquartile range, 28-33). Questions regarding satisfaction with one’s financial condition and investment-risk tolerance used a 10-point Likert scale (1=lowest, 10=highest). Respondents answered 20 questions on personal finance and 28 questions about their own financial planning, attitudes, and debt.

Methods: A cross-sectional, anonymous, web-based survey was administered to a convenience sample of residents and fellows at two academic medical centers. The finance facility will be provided subject to the terms and condition contained in the facility offer letter (if issued by Bank Alfalah Limited offering me/us the facility.Objectives: This study aimed to assess residents’ and fellows’ knowledge of finance principles that may affect their personal financial health.

Bank Alfalah Limited reserves the right to reject my/our application at its sole discretion and will inform me in writing along with reason of rejection. I/We undertake, the details of this application form are correct, complete and accurate and I/We have not withheld any information. 14 of 2020 dated Maof the State Bank of Pakistan. Any deferral /rescheduling of facility granted to me by you shall be governed by Circular Letter No. However, in case of any late payment charges, I/We shall be liable to pay before final settlement and closure of the relationship. I/We understand that any financial charges (Markup, Insurance, etc.) which are already booked by the Bank on my behalf/Loan shall be paid by me/us during the deferral period as and when demand raised by the Bank for my/our loan restructuring/deferment.

0 kommentar(er)

0 kommentar(er)